The importance of digitalization in finance

Technology and online services continue to penetrate our lives, and the financial industry is no in any way immune to this trend. Whether it’s ApplePay, PayPal or banking applications, digital transformation is here to stay. Clients are getting used to the simplicity of the almost instantaneous digital service and providers are motivated to react fast.Currently, more than 50% of finance organizations are redeveloping their approach. So it is no wonder at all, that the amount of the financial organizations that will develop a mature strategy in the next 2-3 years will double. According to the Hackett’s Group Digital Transformation Performance Study, it takes digital leaders about 2.5 years to change their strategy.

The 2019 Key Issues Study shows that at this time those resources are only available to 24% of financial organizations. So it is no surprise, that according to the study, IT budgets for the transformation will rise in the next year. To name a few things: higher standardization, automated processes, improved performance, and customer experience.

Advantages of digitalization in business: banking sector

According to the new report from Accenture, retail and commercial banks have invested globally over $1 trillion in the past 3 years to transform their IT services. Digitalization is different for every industry, but it seems to be crucial for the banking industry because it is one of the most data-driven fields. As Gartner estimates, as many as 80% of traditional banks will go out of business by 2030.Therefore, the challenge to make this information easily accessible and at the same time provide meaningful insights is so much bigger. But digital transformation can also contribute to the engaging and fulfilling customer and employee experience.

That is why it is time to start educating the new generation of workforce and recruit new talent. Going digital has really affected the workforce. Yes, automation can result in staff reductions, but it can also increase the demand for data scientists.

The industry already uses mobile apps, IoT, card readers, and sensors that made real-time financing a reality. All of that will make a possible further business transformation, adding technologies like AI and blockchain to the common instruments of the industry. But the next step is at least as much important. According to Boston Consulting Group, even a few key improvements can have a great impact on the overall performance and can potentially increase revenues up to 20%, while reducing costs by as much as 25%.

Digitalization of banking: Where do we stand now?

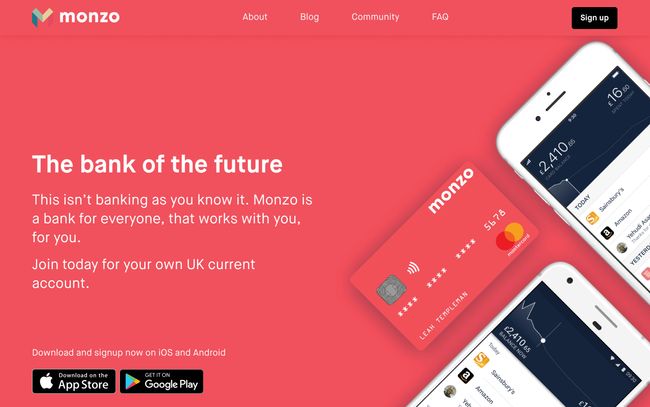

Banks all over the world spend billions of dollars each year to enhance their digital performance. More and more banks are starting to realize that their online presence is as important as their branches or ATMs, sometimes even more so.According to Forrester, one of the most important trends in the industry is online banking, 73% of U.S. adults use this service at least once a month. More clients than ever rely on multiple channels. Around 20% of consumers visit a bank, use online service and banking apps each month.

Challenges of digitalization in banks

The banking industry is also subject to high-security risks due to personal information and transaction records, while the necessity to meet the compliance requirements makes it even harder to implement any changes.According to the 2018 Retail Banking Trends and Predictions report, 69 percent of banks are unable to innovate due to this problem. So this undeniably is the key factor that is standing in the way of successful digital transformation for every bank. The most difficult problem to overcome on the road to digitalization in banking is legacy systems and systems integration challenges.

Digital transformation is not a project with a deadline, but an ongoing journey of change. Hopefully in the near future banks will be able to overcome the challenges, shape new business models with the help of IT, and get one step closer into the new robust digital tomorrow.